Cryptocurrency has grown beyond just buying and selling coins. The emergence of decentralized finance (DeFi) has opened up new earning opportunities for crypto holders — yield farming stands out as one of the most popular. But what does this mean, and how do liquidity pools factor into it?

Let’s explain it all in simple terms even for those new to crypto.

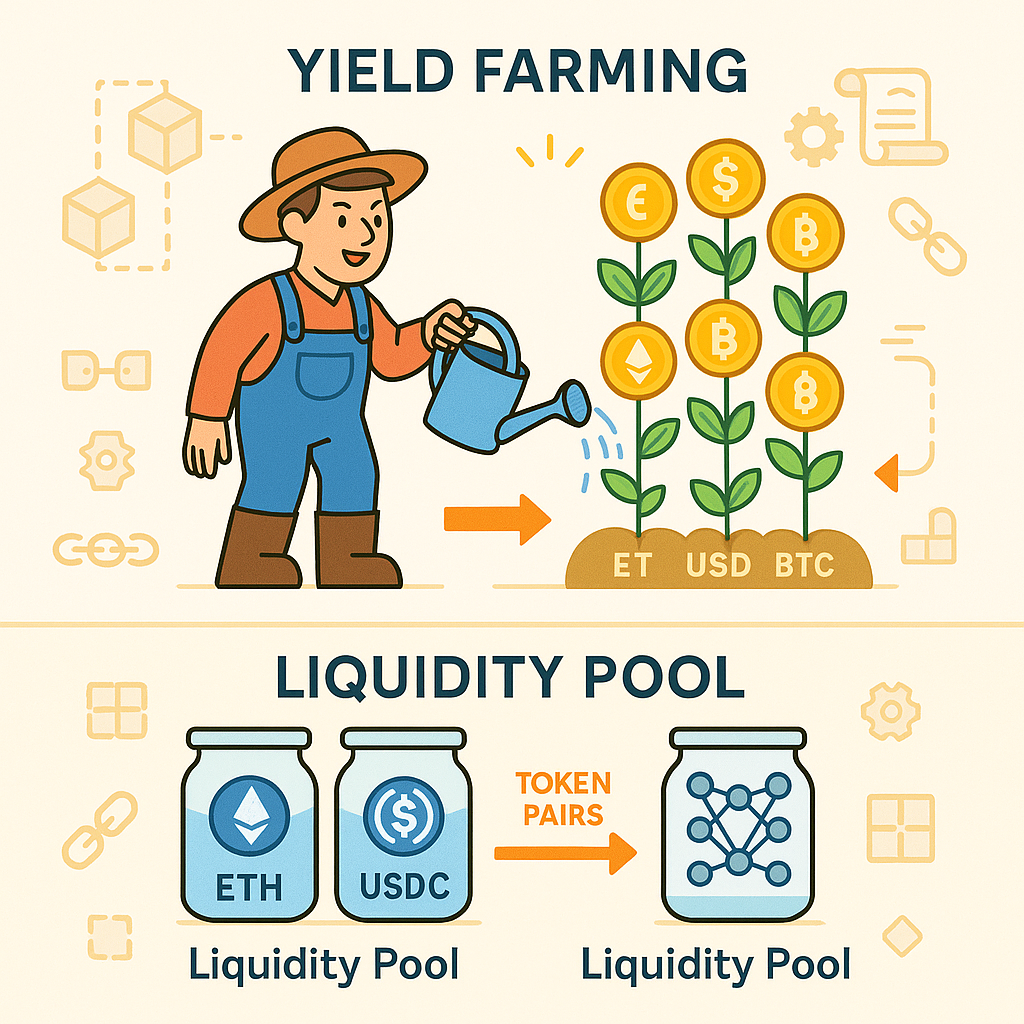

What Is Yield Farming?

Yield farming allows you to earn rewards on your crypto by locking it into a smart contract. It’s similar to depositing money in a savings account, but you use a blockchain-based platform instead of a bank.

When you join yield farming, you lend your crypto to a DeFi protocol. In exchange, you earn interest or token rewards. These earnings come from trading fees or incentives the platform offers.

put: your crypto works for you, and you get rewards for it.

What Are Liquidity Pools?

To get a better grasp of yield farming, you should understand what a liquidity pool is.

A liquidity pool is a large collection of crypto tokens locked in a smart contract. These tokens help trading on decentralized exchanges (DEXs) like Uniswap or PancakeSwap.

Here’s how it works:

- Users put two tokens (like ETH and USDC) into the pool.

- Traders can then exchange these two tokens using the pool.

- As a liquidity provider, you get a small cut every time someone trades using your tokens.

This cut is your reward for helping the platform stay “liquid” — in other words, for making sure people can always trade without delays.

How Yield Farming Uses Liquidity Pools

When you supply crypto to a liquidity pool, you receive a special token in return — often called an LP token (Liquidity Provider token). This token stands for your share of the pool.

You can then take that LP token and put it in a yield farm — a special program that gives extra rewards.

For example:

- You put ETH and DAI into a pool.

- You get LP tokens for that pool.

- You put those LP tokens in a yield farm to earn the platform’s native token (like UNI or CAKE).

So you Learn:

- A part of the trading fees

- Bonus tokens for farming

It’s like getting two incomes from the same deposit.

Why Is Yield Farming Popular?

People love yield farming because it can offer better returns than traditional investments. Instead of just keeping your crypto in a wallet, you make it work for you.

Benefits include:

- Passive income from fees and rewards

- Compounding chances (earnings that grow on earnings)

- Getting new tokens early

- No banks or middlemen needed

But it’s not without risk — and you should know this.

What Are the Risks?

While yield farming can make money, it has some big risks:

- Impermanent Loss: When one token in your pair drops in value more than the other, you might lose potential profits.

- Smart Contract Bugs: A flaw in the code could lead to loss or theft of your funds.

- Rug Pulls: Some projects turn out to be scams that take your money and vanish.

- Market Volatility: Sharp swings in crypto prices can affect your returns.

So while the rewards may seem attractive, you should always research thoroughly before you invest.

How to Begin Yield Farming Safely

If you’re set to give it a try here are some tips for beginners:

- Start small: Experiment with a tiny amount to get a feel for how it operates.

- Use trusted platforms: Stick to well-known names such as Uniswap, Aave, or Curve.

- Read the fine print: Understand what you’re putting in, what rewards you’ll receive, and what risks you’re taking on.

- Track your returns: Monitor performance to know when to withdraw or put in more.

The more knowledge you have, the safer and wiser your farming journey will be.