In the DeFi space, keeping users engaged and maintaining sufficient liquidity poses an ongoing challenge. While many projects offer incentives to encourage users to deposit funds, this strategy often falls short in the long term.

Enter Protocol-Owned Liquidity (POL), a groundbreaking concept that’s shaking up the industry. POL gives DeFi projects greater autonomy, decreases reliance on external support, and fosters more robust ecosystems. Let’s explore the mechanics of POL and its significance.

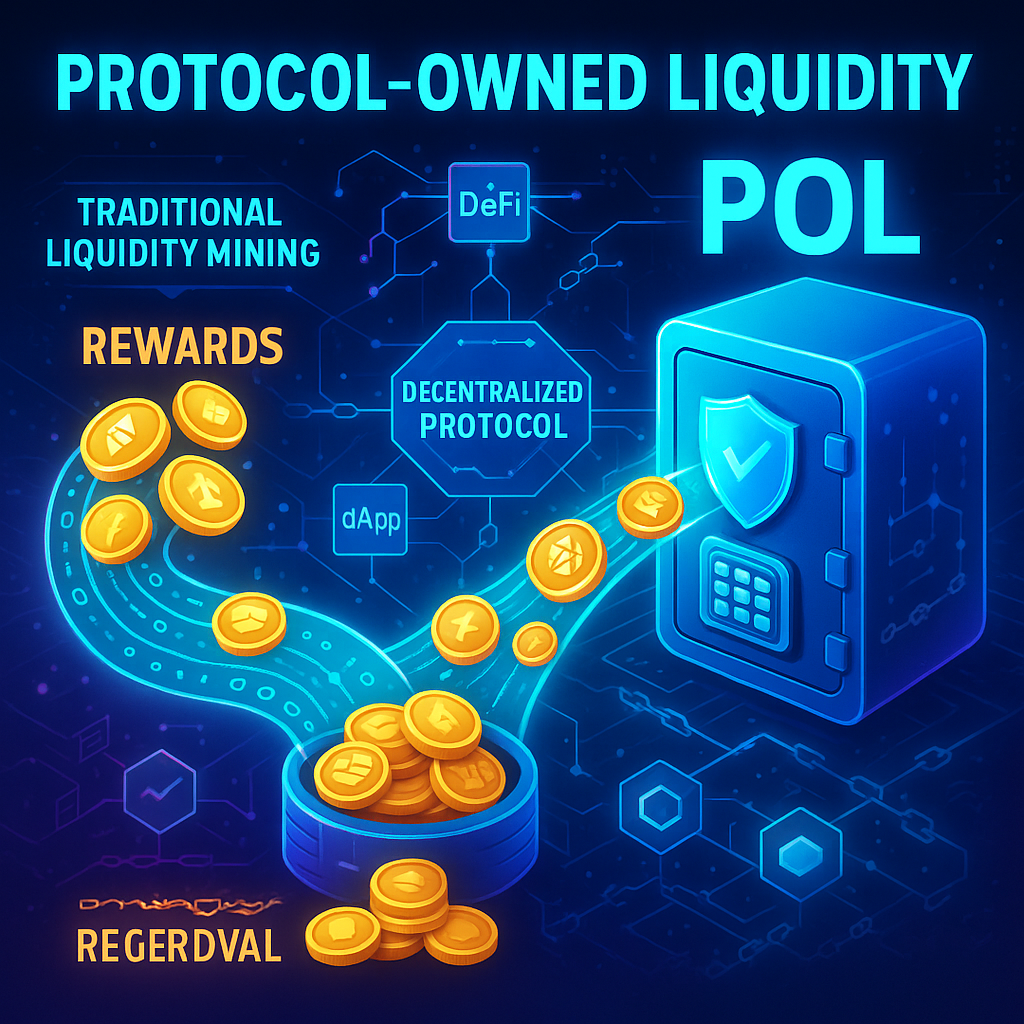

💸 What’s the Problem With Traditional Liquidity in DeFi?

In most DeFi systems, liquidity (the number of tokens available to trade) comes from users who put their tokens into liquidity pools. We call these users liquidity providers (LPs), and they get tokens as rewards for their help.

The problem?

- Many users join just to get rewards and leave when the payouts slow down.

- This leads to shaky liquidity — bad for users and the protocol.

- Projects end up spending big on rewards just to keep liquidity from vanishing.

This approach costs a lot and won’t last long.

🧠 What Is Protocol-Owned Liquidity (POL)?

Protocol-Owned Liquidity (POL) turns this concept upside down. Rather than depending on outside users, the protocol takes on the role of liquidity provider.

Here’s the process:

- The project purchases its own liquidity pool tokens, which stand for shares in token pairs (such as ETH/DAI).

- These tokens gain trading fees when people use the pool.

- Since the project owns them, it doesn’t need to plead with users to remain.

This gives the protocol complete control over its liquidity and builds long-term stability.

🛠️ How POL Enhances DeFi Incentives

POL offers several benefits compared to the previous model:

✅ 1. Liquidity That Sticks Around

The project’s ownership of liquidity ensures it doesn’t disappear when users opt out.

✅ 2. Less Dependence on Token Giveaways

Projects can avoid distributing their own tokens, which helps maintain token value stability.

✅ 3. Consistent Cash Flow

Protocols earn trading fees by owning LP tokens — providing them with a steady income stream.

✅ 4. Improved Alignment

POL pushes teams to prioritize long-term growth over short-term buzz. This approach benefits both the project and its community.

🔍 OlympusDAO: A Real-Life Example of POL at Work

A solid illustration of POL is OlympusDAO. Instead of borrowing liquidity, they created a system where users could sell LP tokens to the protocol and get discounted OHM tokens in return.

This helped Olympus:

- Own its liquidity

- Cut down on reward payments

- Boost its token economy

It also sparked other projects to adopt similar concepts.

🔮 Why POL Matters for the Future of DeFi

As DeFi matures more projects aim for stability and self-sufficiency. POL offers a smarter approach to:

- Cut costs

- Maintain steady liquidity

- Build long-term value

It marks a move towards healthier more lasting decentralized finance.